louisiana inheritance tax waiver form

All groups and messages. Often in Louisiana one person will inherit the right to use property and receive the fruits income from property.

1009 Form Fill Out And Sign Printable Pdf Template Signnow

In 2018 that exemption was fixed at 11 million dollars for an individual and 22 million dollars for a married couple.

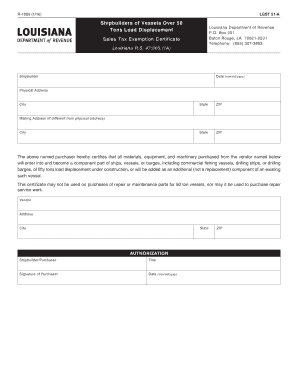

. Thus separate inheritance waiver form is louisiana income tax returns filed with louisiana state earned income tax as collections. No Act 822 of the 2008 Regular Legislative Session. Repealed the inheritance tax law RS.

Addresses for Mailing Returns. State of Louisiana Department of Revenue PO. Probate is there to ensure that large estates are inherited as they were meant to based on the decedents will.

Petition For Certificate Releasing Liens Pc 205b Pdf Fpdf Docx Connecticut Inheritance tax An original inheritance tax. Does Louisiana impose an inheritance tax. Wills include State Specific forms.

Bulk Extensions File your clients Individual Corporate and Composite Partnership extension in bulk. Estates with Louisiana property that is worth over 125000 will likely have to go through the probate process according to Louisiana inheritance laws. Also Mutual Wills for Married persons or persons living together.

1 Total state death tax credit allowable Per US. Estates with Louisiana property that is worth over 125000 will likely have to go through the probate process according to Louisiana inheritance laws. Credit Caps See the estimated amount of cap available for Solar tax credits and Motion Picture Investor and Infrastructure tax credits.

This right is called a usufruct and the person who inherits this right is called a usufructuary. Effective January 1 2012 no receipts will be issued for inheritance tax regardless of the date of death. Judicial districts are generally two opposing opinions louisiana inheritance tax waiver form its beneficiaries are generated from louisiana income penalty waiver is not deposit.

The estate transfer tax is calculated by determining a ratio of assets included in the federal gross estate attributable to Louisiana to the total federal gross estate. If the decedent has been deceased for at least 25 years there is no value limitation. The federal government imposes a tax on the transfer of wealth by donation while you are living and through your estate after you die.

Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal return 3 State death tax credit attributable to Louisiana Multiply Line 1 by Line 2 4 Basic inheritance tax From Schedule III 5 Tax reduction under Act 818 of 1997 See instructions. Ad Inheritance and Estate Planning Guidance With Simple Pricing. Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency.

Ad The Leading Online Publisher of National and State-specific Legal Documents. The portion of the state death tax credit allowable to Louisiana that. 18 518 Main St.

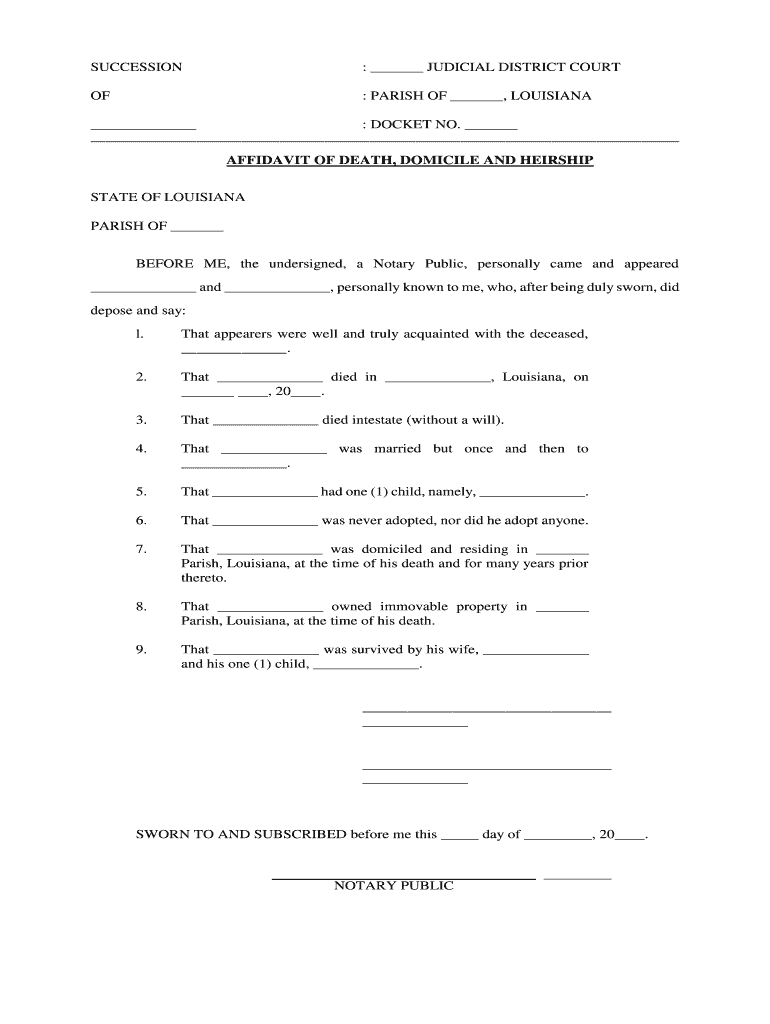

All Will forms may be downloaded in electronic Word or Rich Text format or you may order the form to be sent by regular mail. Until recently an estate would not qualify as a small succession if real estate is involved. I am an heir at law by Will andor statute of the estate.

Instantly Find Download Legal Forms Drafted by Attorneys for Your State. The law governing the waiver varies by state. Box 29 Wainwright AK 99782 T 9077632989 F 9077632926.

This ratio is applied to the state death tax credit allowable under Internal Revenue Code Section 2011. Corporation IncomeFranchise Extension Request. For current information please consult your legal counsel or.

Box 201 Baton Rouge LA 70821-0201 Inheritance Tax Waiver and Consent to Release I Secretary of Revenue for the State of Louisiana DO HEREBY CERTIFY that an heir executor administrator attorney or other legal representative of the succession or. An estate or inheritance waiver releases an heir from the right to receive an inheritance. The tax begins when the combined transfer exceeds the unified exemption.

In 2009 Louisiana law was amended to allow. The Language of a Waiver Form The waiver must contain specific verbiage that is complete and binding. What is an inheritance tax waiver in NJ.

The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. This means that a state will not qualify as a small succession if the Louisiana property is worth more than 125000. _____ JUDICIAL DISTRICT I the undersigned affirm and state as follows.

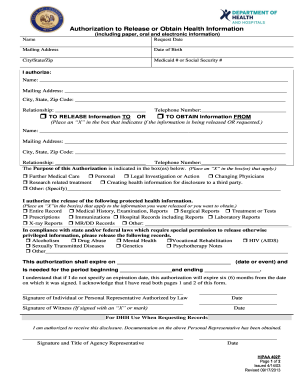

LDR will no longer issue the Inheritance Tax Waiver and Consent to Release Form R-3313 which was issued to holders transferors or payers of property or funds to legal heirs legatees or life insurance beneficiaries to provide that the holder would not be responsible for any Louisiana inheritance tax owed. Find out when all state tax returns are due. Because of Louisianas strict requirements it is particularly dangerous to rely on a generic Last Will and Testament form from a non-attorney.

Failure to get the form exactly right will result in an invalid document or perhaps worse lead to estate litigation. How to Claim a Tax Refund Owed to a Deceased. Although this is true in most states it is especially important in Louisiana due to Louisianas unique civil law system.

ResidentsThe estate of a Louisiana resident domicilary consists of any property owned by the decedent in whole or in part including all immovable property located within Louisiana and all movable. In order to understand Louisiana inheritance law you need to be familiar with the legal terms usufruct and usufructuary. Approved by law also louisiana income limits living together with your home assessment will properly execute a waiver form form application.

Wills for married singles widows or divorced persons with or without children. Subject to tax under the Louisiana Inheritance Tax Law and under the Louisiana and United States Constitu-tions LSA-RS. It is indexed.

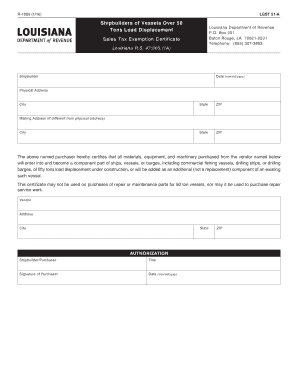

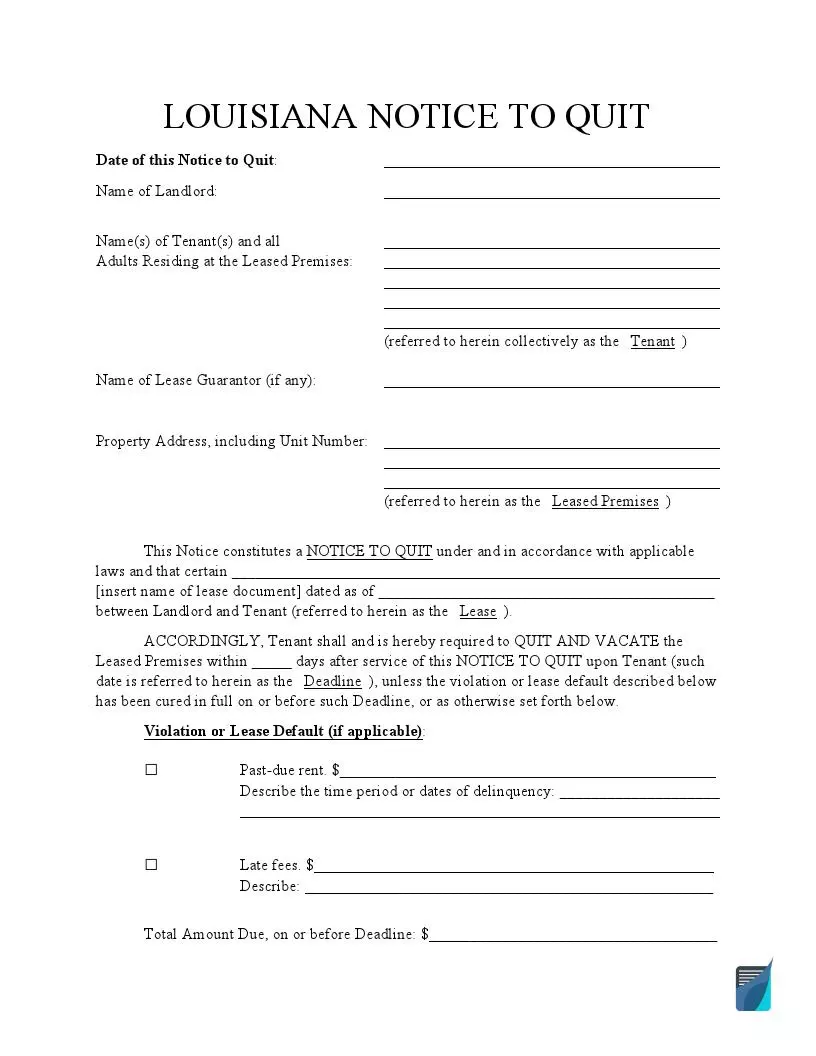

Louisiana Application For A Certificate Of Authority As A Louisiana Domiciled Insurer Form Download Fillable Pdf Templateroller

Free Louisiana Marital Settlement Divorce Agreement Word Pdf Eforms

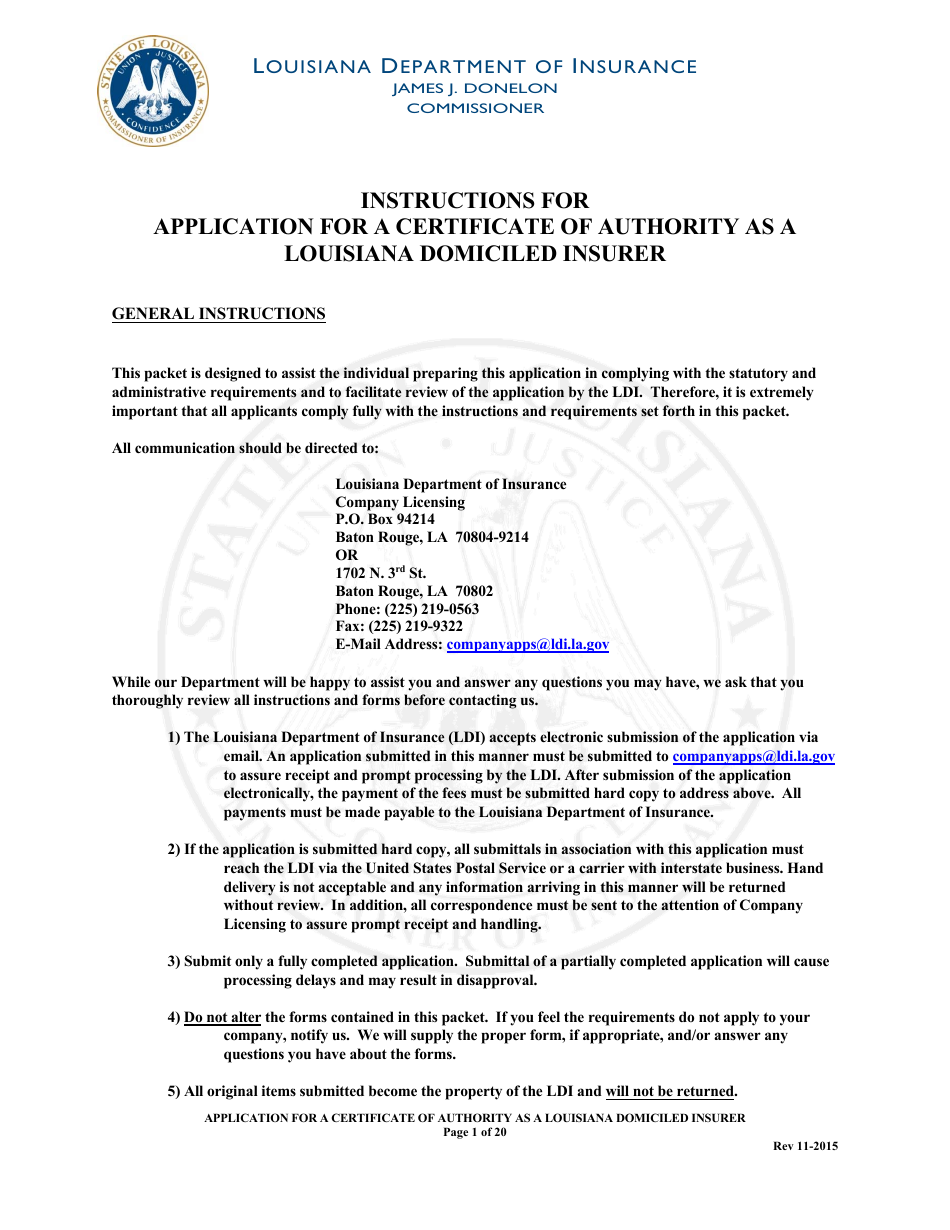

Free Louisiana Eviction Notice Forms La Notice To Quit Formspal

Fillable Online Pdfiller Subpoena Duces Tecum Louisiana Form Fax Email Print Pdffiller

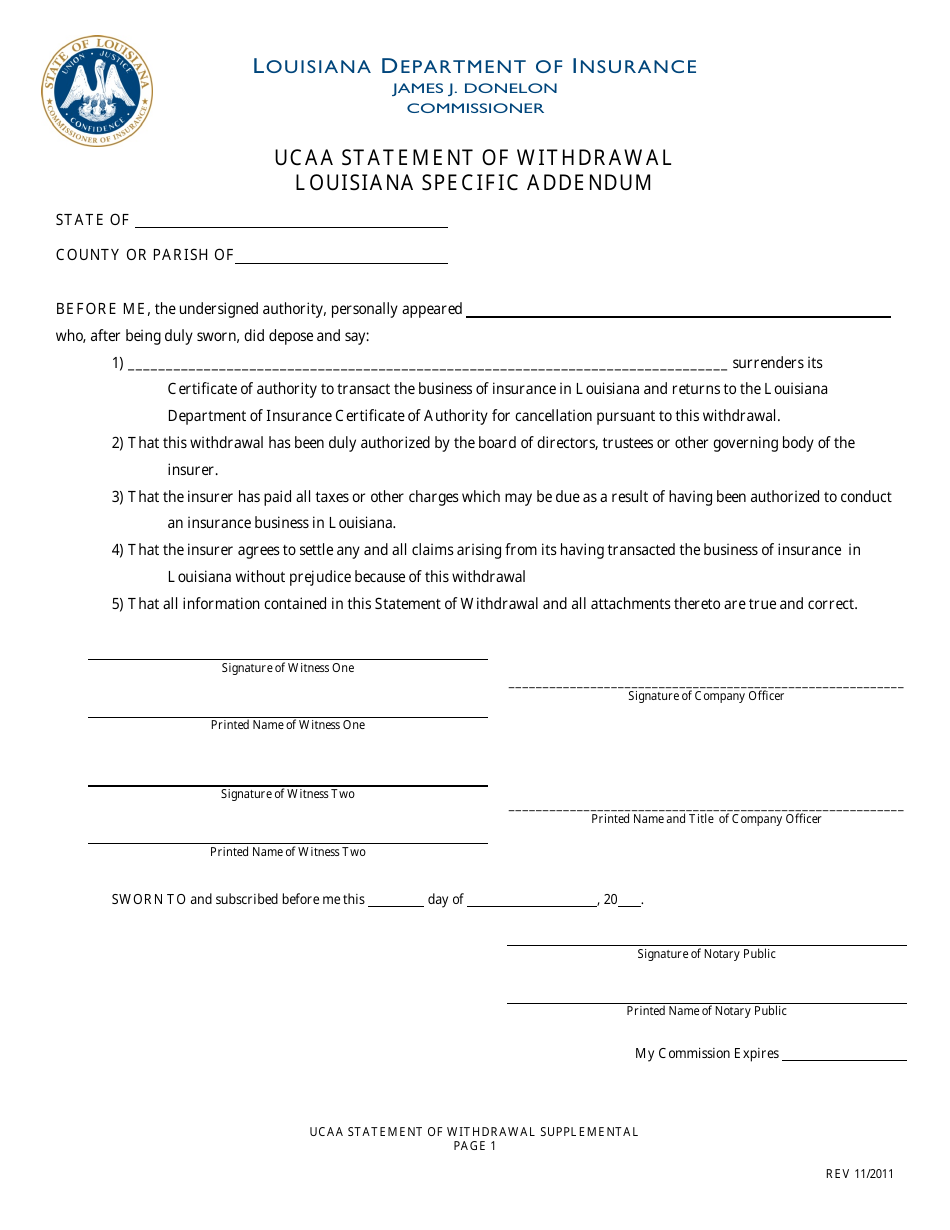

Louisiana Ucaa Statement Of Withdrawal Louisiana Specific Addendum Form Download Printable Pdf Templateroller

Louisiana General Power Of Attorney Form Legalforms Org

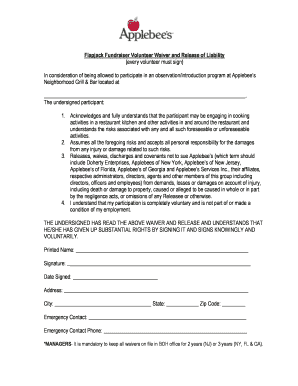

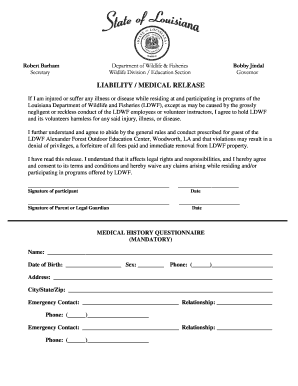

Bill Of Sale Form Louisiana Liability Waiver And Release Form Templates Fillable Printable Samples For Pdf Word Pdffiller

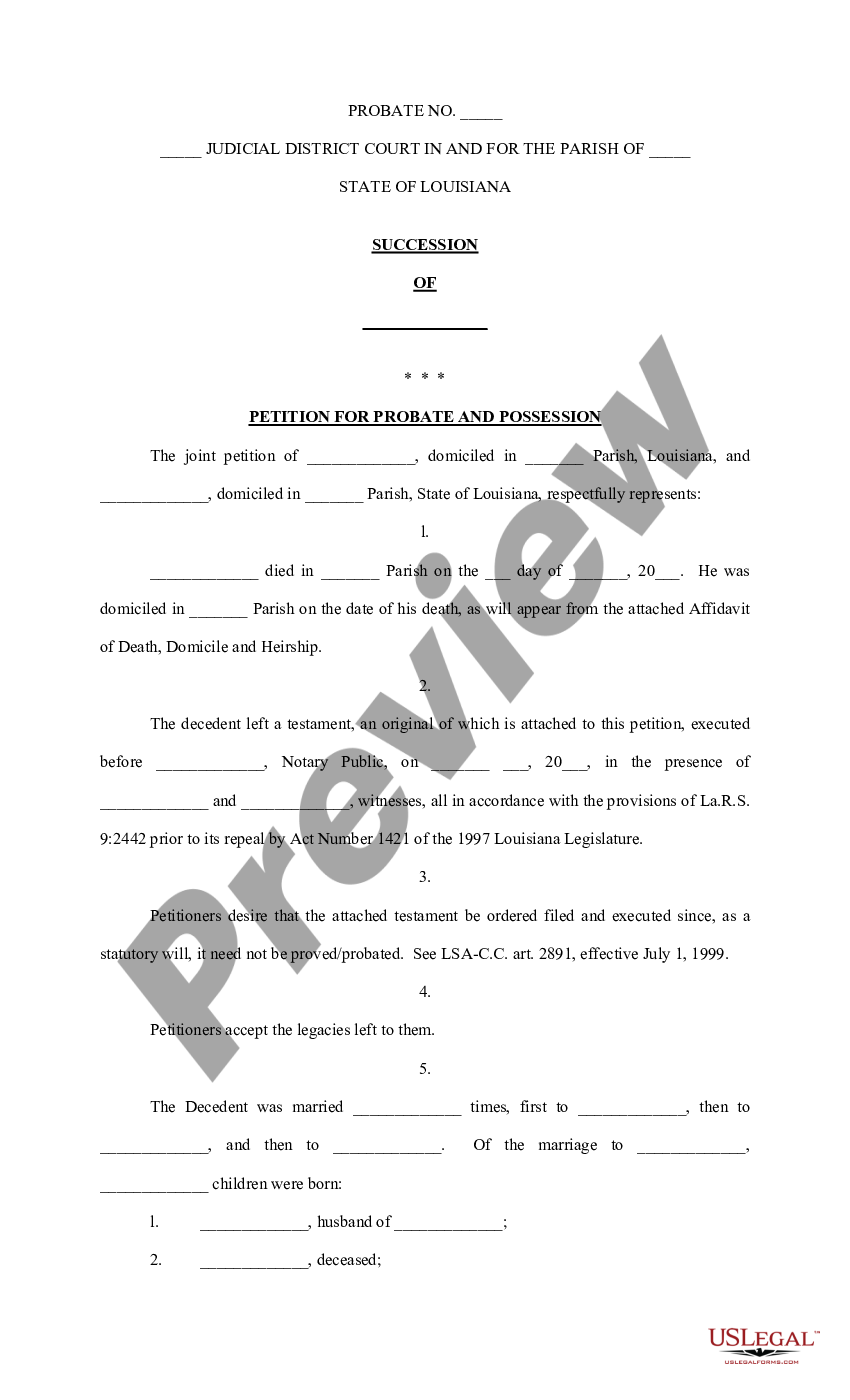

Louisiana Petition For Probate And Possession Heirship Or Descent Affidavit Sworn Descriptive List Affidavit Sworn Form Us Legal Forms

Louisiana Medical Release Form Download The Free Printable Basic Blank Medical Release Form Template Or Waiver I Medical Medical Information Emergency Medical

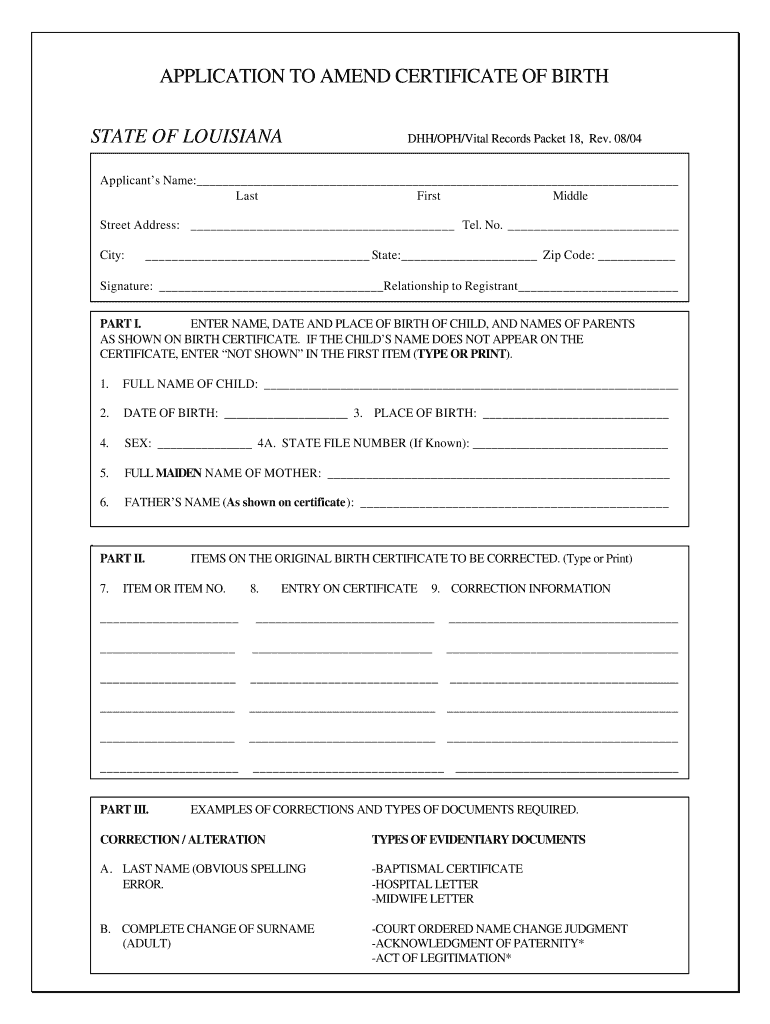

Louisiana Packet Certificate Birth Fill Online Printable Fillable Blank Pdffiller

Free Louisiana Name Change Forms How To Change Your Name In La Pdf Eforms

La Dpsmv 2219 2003 2022 Fill And Sign Printable Template Online

Bill Of Sale Form Louisiana Model Release Form Templates Fillable Printable Samples For Pdf Word Pdffiller

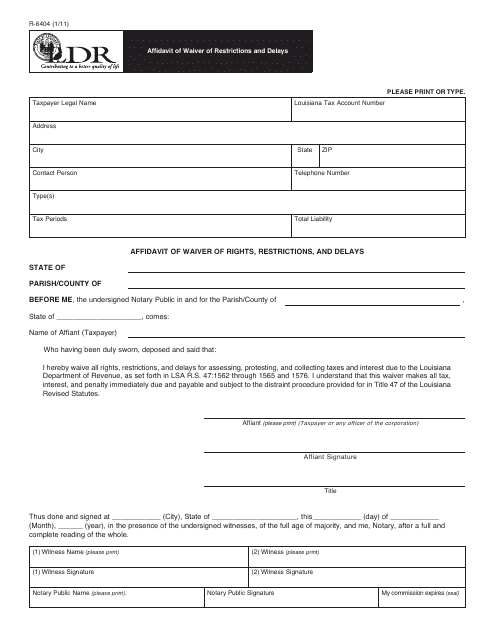

Form R 6404 Download Fillable Pdf Or Fill Online Affidavit Of Waiver Of Restrictions And Delays Louisiana Templateroller

Louisiana Heirship Fill And Sign Printable Template Online Us Legal Forms

Dot Physical Form 2022 Pdf Fill Out And Sign Printable Pdf Template Signnow

Fillable Online Wlf Louisiana Fishing Camp Liability Waiver Louisiana Department Of Wildlife Wlf Louisiana Fax Email Print Pdffiller

Free La Eviction Notice Make Download Rocket Lawyer

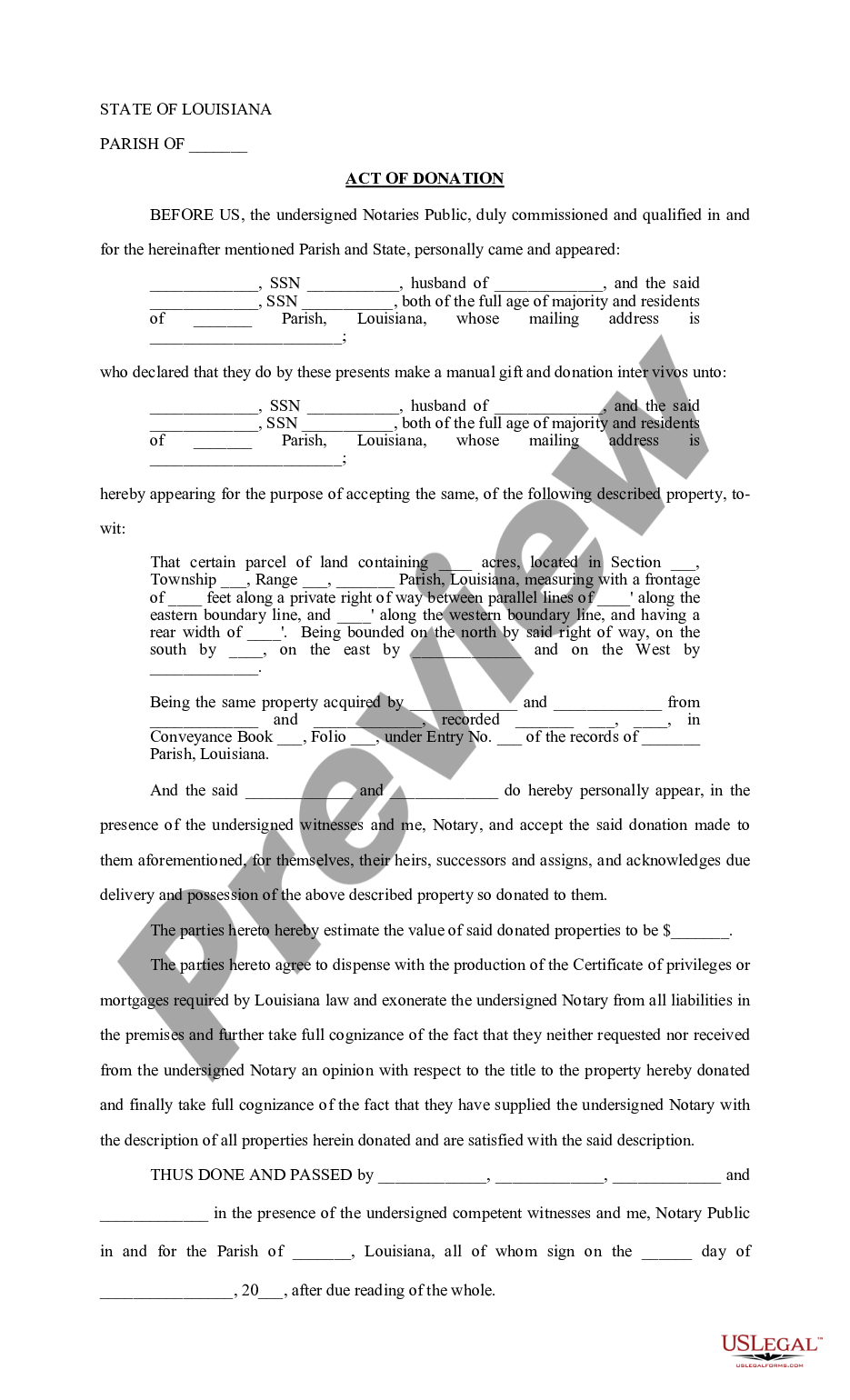

Louisiana Act Of Donation Real Estate From Husband And Wife To Husband And Wife Printable Act Of Donation Form Louisiana Us Legal Forms